A few weeks ago I was privileged to be able to interview Alina Golubieva (pictured), who has spent the last four years establishing an insurance broking business in Kyiv. The interview was published in Insurance Post and they have been kind enough to allow me to publish it here so that more people can read it as it tells a powerful story of how resilience and hope are so much part of the Ukrainian DNA. The full interview can be downloaded at the bottom of this page.

It goes without saying that the war has hugely disrupted business in Ukraine, as Alina explained to me:

“We had a few clients in Kharkiv, we had clients in Kherson and in Mykolaiv, which wasn’t invaded, but still badly affected. And we had a lot of clients with employees in Mariupol as well. So basically, they relocated to either other parts, or we just saw the numbers there drop drastically.

“So, for example, one of our clients, they had about like 600 people in Kharkiv. Now it is only 50 people and 200 people are in other parts of Ukraine. Some of the people are relocated outside of Ukraine, but the war affected business immensely.

“There were layoffs. Some businesses couldn’t survive, because it affected them so much. And a lot of businesses now are moving their hubs outside of Ukraine, so they can support the business and support Ukrainians who want to relocate and still work for that company.”

You can read how this impacted her business and her predominantly female staff and how they have re-established a physical presence in Kyiv in a co-working office (see picture below). In a typical show of Ukrainian defiance the office complex is symbolically named Перемога (Peremoha) which means Victory in Ukrainian.

Much is being written and said about the potentially malign influence of artificial intelligence on elections, some of it very alarming. The main focus is on deepfakes – artificially generated pictures, audio and video – that are exactly what they say on the label: fakes and forgeries. Just how concerned should we be?

Some experts are keen to play down the threat, including Ciaran Martin, founding chief executive of the UK National Cyber Security Centre, part of GCHQ and is currently professor of practice in the management of public organisations at the Blavatnik School of Government, who I heard speak at a recent Association of European Journalists briefing.

He tried to be reassuring.

“A lot of this is not completely new. It is just that the technology has made it easier and it enables to spread faster … electoral interference in its current form has been going on for some time. It pre-dates AI by a hundred years.”

He cited the example of the notorious Zinoviev Letter which was published by the Daily Mail during the 1924 General Election campaign. It purported to show proof of connections between the Soviet Union and the British Communist Party and, by implication, the Labour government. It was later proved to be a forgery but its publication just four days before the election contributed to the Labour government’s substantial defeat.

He examined various recent examples from the UK, Europe and United States of attempts to interfere in elections, highlighting where several interventions, in his view, had failed.

The deepfake audio of the Mayor of London Sadiq Khan that was circulated around Remembrance Sunday last year was one example. This did not get much traction, argued Martin, primarily because his principal political opponents – The Conservative Party – and all responsible media outlets were not taken in by it and did not circulate it. That is true but perhaps a trifle naïve in assuming that significantly diminishes the risk of harm from deepfakes.

Given all political parties and their leading figures are vulnerable to this sort of attack there is a mutual interest in being very cautious about latching on to anything that looks or sounds suspect and exploiting it. The mainstream media is also learning quickly to greater care in verifying anything that does not come from an identifiable reputable source. That leaves plenty of scope for concern.

What about when social media is the dominant news outlet?

The growing proportion of people who rely on social media channels for their news is alarming. Several recent surveys have identified TikTok as the top source of news for Gen Z. In America it is increasingly popular as a news source for all generations, perhaps going some way to explaining the insanity of the US Presidential election race.

This brings us right back to the role of social media and the failure of all the major platforms to take responsibility for what is published on their platforms. They are publishers but have escaped nearly all the responsibilities that go with that role. It is fashionable to deride the “MSM” (mainstream media) but it is one of the key pillars of free, democratic societies. It is flawed. It is diverse. It does not always get things right or go about its role in ways that people find acceptable. But it is subject to the law and that law makes it ultimately responsible for what it publishes. Why are social media platforms not similarly regulated?

Recent moves such as the UK’s Online Safety Bill go some way but fall short of creating a mechanism powerful enough to stop the harm from deepfakes and other malicious online content, which goes far beyond the political sphere.

Of course, it would undermine their business model if they were treated as publishers as they would suddenly have to employ vast numbers of people to scrutinise and check content. Pre-publication verification would cripple them. That does not mean we should not be moving in that direction. Protecting society is far more important than protecting the business interests of the tech and social media giants.

Alongside that the MSM has to raise its game. Initiatives such as BBC Verify are a big step in the right direction. They bring to the fore what most media outlets have been doing for a very long time, helping reinforce the message that in this age of AI and social media you cannot always believe what you see and hear.The debate about the place of AI in society has only just started and we must not let its darker applications obscure the good it can do. Neither must we dismiss its potential to be used for nefarious purposes. Take away the outlets and you take away the incentives to use AI to cause harm and undermine our democratic processes.

• The images used in this article were generated using the AI tools in the Adobe Stock media library.

Two years since bombs and missiles started raining down on Ukraine and we are still waking up to reports of yet another bombardment of Ukrainian cities. People talk about the western democracies wearying as the war enters its third year. Think about how the people of Ukraine feel, both those still in their country – perhaps on the frontline – and those who have sought refuge elsewhere. They cannot afford the luxury of questioning the stubborn resistance to the Russian invasion: it is their country, their way of life, their culture that is a stake.

We have much at stake too. Democracy, freedom and the right of nations to determine their own future free from the threat of tyranny and repression. These are the values that are the foundations of western democracy. If we weary of standing by Ukraine and its people as it defends those values then we put our own way of life at risk, if not by way of brutal physical assault but through a degradation of everything good we stand for.

For some in our European family the threats are more physical and they know it. Look at the defensive lines the Baltic states are building along their borders if you want proof of the fear that stalks Europe as the spectre of Russian brutality casts its darkening shadow across our continent.

This is a European war and one that Europe may have to learn to fight alone, without the military might of the United States. Just when it is needed, America is becoming an unreliable ally, in danger of lurching back to the isolationism of the 1930s that Nazi Germany saw as a green light to invade its neighbours. Under a Trump presidency it could be even worse. He has already cast himself as Putin’s cheerleader. Far from being great again, America will be reviled by western democracies if it abandons them as Trump urges.

We are remembering Ukraine today because it is an anniversary but with the appalling conflict in Gaza hogging the headlines it has become easy to forget the suffering of the people of Ukraine. We must not let that happen.

• I was privileged to be part of a special Vespers for Ukraine at Brentwood Cathedral last night to pray for peace in Ukraine. It is a small contribution to supporting those, mainly mothers and children, displaced by the war and now part of our community, but one that is important nevertheless.

There were many Ukrainians in the congregation, some of whom read and said prayers in Ukrainian. We included several Ukrainian pieces of music in the service and the Ukrainians afterwards paid us the great compliment of saying we sounded like a true Ukrainian choir, mastering the sounds of their language and the deep feeling that the music embraces. I hope that gave them comfort in their fragmented lives far from home.

Photo: Graham Hillman

Slava Ukraini

This question has been gnawing away at me ever since the flurry of excitement across the London insurance market in the wake of Chancellor Jeremy Hunt’s promise to consult on the possibility of creating a special regulatory regime to attract captive insurance companies to London. I think we might be edging nearer getting an answer.

This week’s Labour charm offensive to the business community and financial services sector has offered a myriad of clues as to what their approach might be.

The promise by Labour’s shadow chancellor Rachel Reeves to “unashamedly champion” the financial services sector was rather overshadowed by the accompanying announcement that Labour would not reintroduce the cap on bankers’ bonuses. I am not sure what Labour thinks it has to gain by this. The ditching of the cap was one of the many controversial decisions made by the short-lived and disastrous Truss government. Reinstating it would be an obvious easy win for any party looking to place itself on the side of ordinary people battered by the endless waves of financial crises.

Championing the City of London and the key financial services sector makes more sense. Labour needs to keep capital and the business it generates in London if it is to deliver the financial stability lacking under the Tories in recent years and finance its commitment to restore public services.

This should mean that the captive insurance proposals developed by the London Market Group get a fair hearing if Labour forms the next government.

Where are the staff?

To deliver the huge benefits LMG and its supporters claim will take more than the creation of a more appropriate regulatory regime, however. That should be the easy part as there are plenty of models nearby. Luxembourg, Ireland and recently France have all shown how regulatory regimes for captive insurers can be accommodated within the rigorous European Union insurance regime. In the United States, Vermont has a thriving captive sector living alongside domestic insurers.

A key challenge so far little remarked upon will be staffing.

The London insurance market already describes itself as being in the midst of an escalating war for talent. The arrival of captive insurers will exacerbate the already alarming skill shortages across the market. It will also push up wages, blunting some of the appeal of London as a new captive domicile.

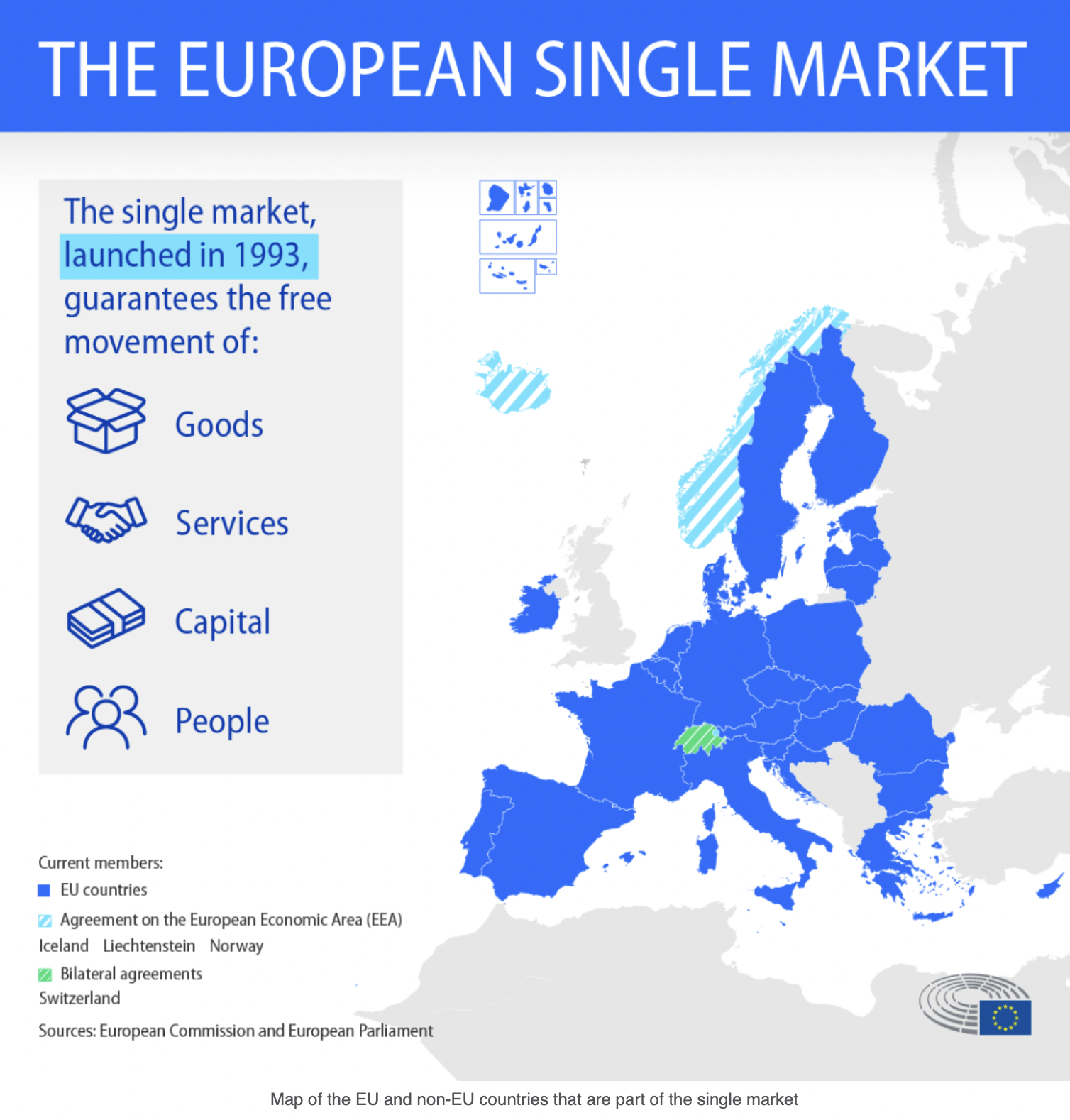

Of course, one solution that could ease that would be to restore the free movement of people across the EU. This would probably have to be part of setting the UK on a trajectory to rejoin the Single Market which would never be acceptable to a Tory Party still blighted by deep splits over Europe but could find more favour with an incoming Labour government. This would not be undoing Brexit as the extremist anti-EU elements inside and outside the Tory Party claim. The Single Market was not on the Brexit referendum ballot paper and leaving it should never have been part of the Brexit settlement.

To make the captive insurance market plan work is going to require an engagement with bigger issues than tweaks to the City’s regulatory regime.

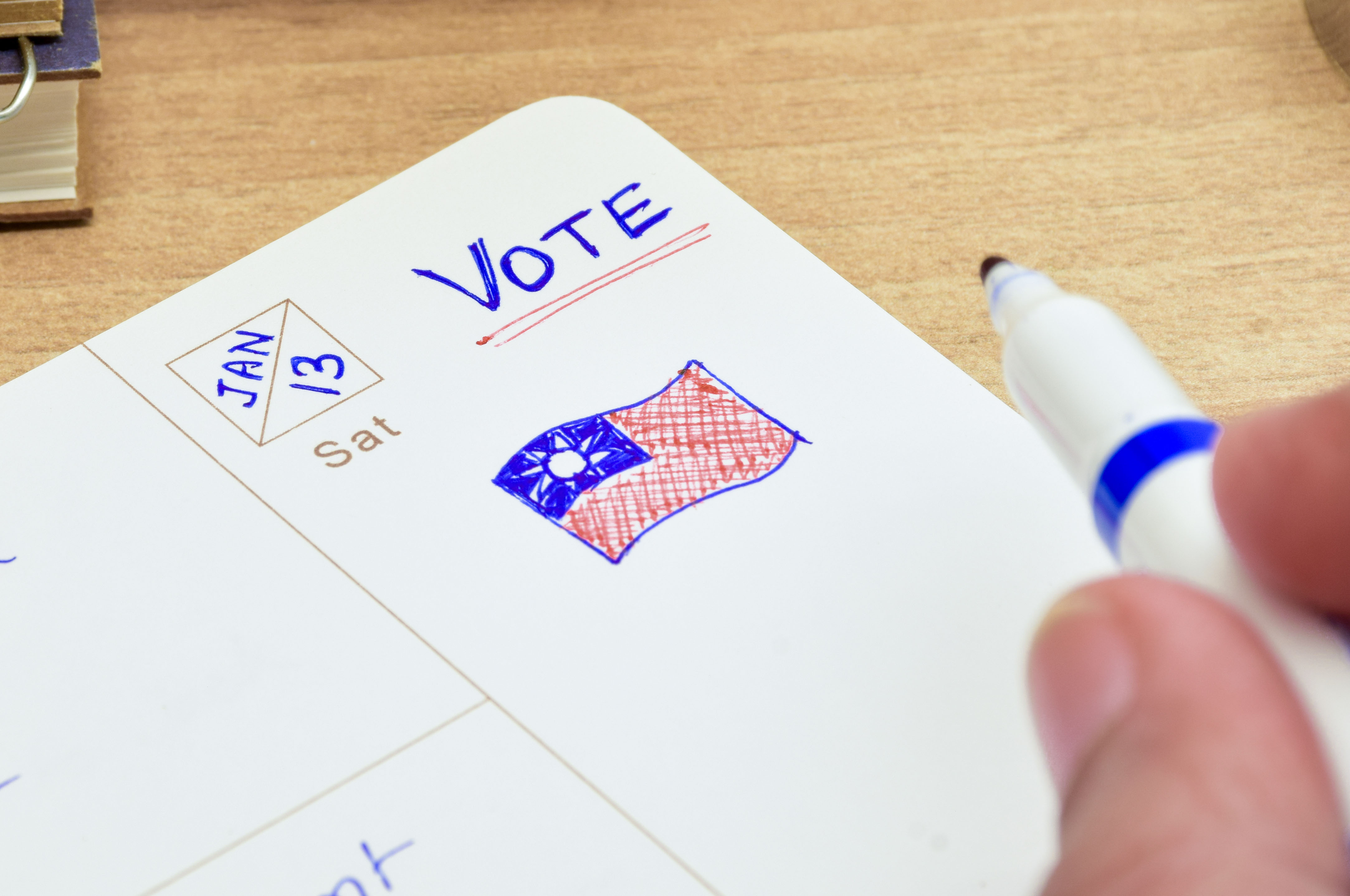

This is the year of the ballot box. Over 50 national elections involving a potential 4 billion voters going to the polls are due to take place this year. They could leave the world looking rather different by the end of the year.

The potential of one set of elections to influence the next is endless, especially as they are taking place at a time of heightened geo-political tensions.

United Kingdom

Of course, for us in the United Kingdom we are most focussed on our own General Election which must at least start in 2024, although it could still be running in January next year. That prospect seems unlikely. The big question is: will it be May or will it be in the autumn?

That this is the dominant political story in the UK, exposes one of the huge shortcomings of our political system – placing the power to determine the date of the General Election in the hands of the Prime Minister. The corrosive impact of the uncertainty this creates has long been recognised but the attempt to introduce fixed term, five year Parliaments did not outlast the Coalition government of 2010-15.

We have now entered a phase where every political decision, every utterance by party leaders and every policy announcement is judged in terms of its impact of the potential date of the election and its outcome. This does not make for good government, although that is something the Tories abandoned long ago amid the post-Brexit chaos of five Prime Ministers in seven years.

The choice for Sunak seems to be about choosing a date that causes the Tories the least damage in terms of lost seats, as any prospect of holding on to power finally vanished when his hapless predecessor crashed the economy in September 2022. It is also being heavily influenced by the open manoeuvring around the Tory leadership after the anticipated defeat.

The UK election might be important to us: however, it is a sideshow when it comes to world politics.

Taiwan The first date on this roller-coaster of what could be a series of epoch shaping elections is 13 January, when Taiwan – the Republic of China – goes to the polls. There the battle between the ruling Democratic Progressive Party (DPP) and the main opposition Kuomintang (KMT) is about more about tone when it comes to the all-important subject of Taiwan’s independence and its future relationship with the increasingly aggressive People’s Republic of China. Under Xi Jinping, China has made what it sees as the reunification of China a priority despite the overwhelming majority of Taiwan’s 23.5 million people rejecting the idea.

The first date on this roller-coaster of what could be a series of epoch shaping elections is 13 January, when Taiwan – the Republic of China – goes to the polls. There the battle between the ruling Democratic Progressive Party (DPP) and the main opposition Kuomintang (KMT) is about more about tone when it comes to the all-important subject of Taiwan’s independence and its future relationship with the increasingly aggressive People’s Republic of China. Under Xi Jinping, China has made what it sees as the reunification of China a priority despite the overwhelming majority of Taiwan’s 23.5 million people rejecting the idea.

The DPP has a more forceful approach to Taiwanese independence than the KMT and a maverick third party, the Taiwan People’s Party. China’s notorious propaganda machine has flooded the country with fake news, deepfake videos and wave after wave of disinformation primarily aimed at undermining the DPP.

If there is one theme that links all these elections it is the potential of disinformation campaigns, fuelled by the lax policies of the main social media platforms, to undermine democratic processes.

Should the DPP’s candidate Lai Ching-te succeed despite China’s disruptive efforts then we can expect an escalation in tensions in the South China Sea with Communist China stepping up its military aggression towards Taiwan. The world could quickly find itself balanced on the knife-edge of a wider conflict, testing America’s policy of “strategic ambiguity” to its limits.

Russia

The one so-called election that we can be certain of the outcome is the Russian Presidential election in early March. Putin will win by a landslide majority. He has murdered, exiled or imprisoned the opposition but will still claim the election result as a rousing endorsement of his attack on Ukraine.

Ukraine This is the election that will probably not happen. A week after Putin is carried back into the Kremlin in triumph, Ukraine was due to hold a Presidential election. All elections in Ukraine are currently suspended under the martial law imposed when Russian forces rolled across the border in February 2022.

This is the election that will probably not happen. A week after Putin is carried back into the Kremlin in triumph, Ukraine was due to hold a Presidential election. All elections in Ukraine are currently suspended under the martial law imposed when Russian forces rolled across the border in February 2022.

There is nothing unusual about countries suspending elections in wartime. The UK did it twice in the last century and it is hard to see how fair and free elections can be held when Russia occupies part of the country and much of the essential infrastructure of elections has been damaged or destroyed, but Russia and its supporters will be bound to exploit this for their own propaganda. Hardliners in the US Republican Party opposed to supporting Ukraine are already making noises about the cancellation of the elections as being another reason to abandon Ukraine.

Europe The European Parliament elections will take place in mid-June and are currently predicted to see a strong showing among far-right parties across the continent. This will probably not be enough to depose the centre-right European People’s Party grouping as the largest party in the Parliament but will tilt the balance in the Parliament in a strongly rightward direction, giving a much enlarged platform to parties with strong neo-fascist elements in their ranks.

The European Parliament elections will take place in mid-June and are currently predicted to see a strong showing among far-right parties across the continent. This will probably not be enough to depose the centre-right European People’s Party grouping as the largest party in the Parliament but will tilt the balance in the Parliament in a strongly rightward direction, giving a much enlarged platform to parties with strong neo-fascist elements in their ranks.

This, in turn, will influence to complexion of the European Commission at a time when the EU faces crucial issues around enlargement and continued support for Ukraine. It will also feed through to important national elections in subsequent years, not least the next French Presidential election in 2027.

United States of America By the time America goes to the polls in November, the impact of the elections in the first half of the year will have fed through to its highly polarised politics. This far out it is hard to predict what the impact of that might be, especially as the identity of the Presidential candidates is not certain, although most commentators still predict a re-run of the Biden v Trump contest of four years ago.

By the time America goes to the polls in November, the impact of the elections in the first half of the year will have fed through to its highly polarised politics. This far out it is hard to predict what the impact of that might be, especially as the identity of the Presidential candidates is not certain, although most commentators still predict a re-run of the Biden v Trump contest of four years ago.

The world will be watching nervously as the Presidential election progresses as outside of Republican America and the Kremlin the prosect of a second Trump Presidency is almost unthinkable and certainly highly undesirable.

The Rest

There are plenty of other national elections due to take place next year, not least in the world’s largest democracy, India. As we have recently seen with Argentina, populations are so disillusioned with mainstream politicians that they are sometimes inclined to make bizarre and disruptive choices. Add to that volatile mix the possibility of unscheduled elections in countries like Israel and we can see why the ballot box will be so important this year.

I was delighted recently when the distinguished Washington correspondent Llewellyn King asked me to join him and his fellow presenter, Adam Clayton Powell III, on their popular White House Chronicle programme to talk about what happened in France in June 1940 after Dunkirk fell to the Germans on 4 June.

This, of course, is the subject of my recent book – Operation Aerial: Churchill’s Second Miracle of Deliverance.

The challenge was to pick out some of the stories in the book that would be most likely to appeal to a North American audience. Fortunately, there are several angles that are either universal, such as the sinking of the Lancastria at St Nazaire, feature America journalists, such as the redoubtable Virginia Cowles, or regiments from Canada.

You can watch the result as White House Chronicle kindly gave me permission to share it widely.

The book would make an ideal Christmas present for anyone interested in WW2 history. The complex – and previously untold story – is made accessible by telling it through the voices of the people who were involved.

It is available in hardback or paperback from the publisher Sabrestorm, all good bookshops and on Amazon.

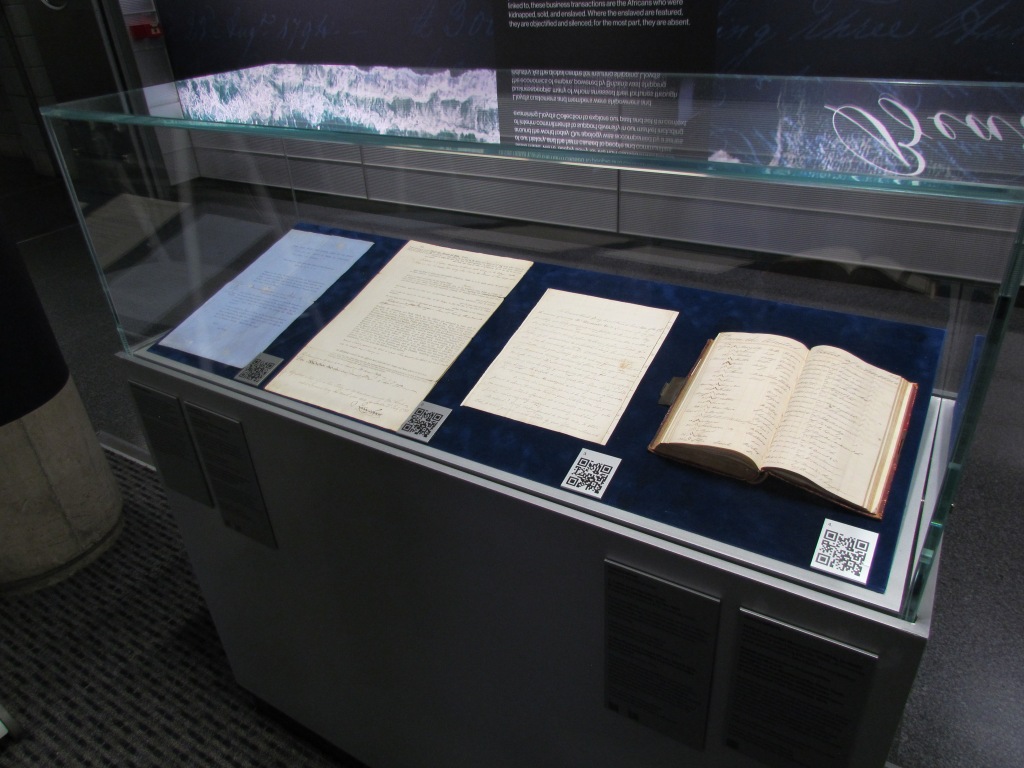

Lloyd’s announcement this week that it is going invest £12m in a series of initiatives to support recruitment and career progression for black and minority ethnic staff, in a programme called Inclusive Futures, as part of its response to the market’s historic involvement in the slave trade has been met with a mixed response.

This follows extensive research by Black Beyond Data, funded by the Mellon Foundation, a project based at Johns Hopkins University in Maryland, USA, which was initiated just over three years ago when the Black Lives Matter movement cast new light on the involvement of London’s powerful financial institutions in financing, supporting and perpetuating the slave trade.

To no-one’s surprise it found that Lloyd’s played a significant role in that vile, brutal and inhumane trade.

In addition to £12m going into Inclusive Futures, Lloyd’s says US$50m (£40m) will be invested globally through the African Development Bank and Inter-American Development Bank focused on “regions affected by historical enslavement”. We await greater clarity on what that means.

Other initiatives include establishing a permanent memorial at Lloyd’s to remember the victims of transatlantic slavery, sponsoring a requiem by composer David Önaç to memorialise enslaved Africans, and inaugurating an annual lecture to be given by speakers on diversity and history – the Flint Lectures – named after the first black broker to work at Lloyd’s.

This is good as far as it goes.

It has run into predictable criticism from some campaigners who want institutions that benefitted from slavery to pay reparations directly to the descendants of slaves. This sounds laudable in principle but would be fraught with difficulties and could see a lot of money spent on administering what would inevitably be a highly complex scheme. The passage of time, coupled with the patchy historical records would mean that identifying the right people and fairly allocating money would be almost impossible.

Is £12m enough? I don’t know the answer to that. It seems a very modest sum considering the extent of its involvement in the slave trade and the wealth of the modern insurance market. I think the pressure to increase that investment and extend the scope of its Inclusive Futures project could well see it increase.

Lloyd’s has done a good job in laying out its past, much of which can be viewed in an online exhibition called Underwriting Souls. There is also a modest physical exhibition in the Lloyd’s building for those who work there to visit.

The big omission, and one that I have raised before, is the lack of any connection to slavery today.

Modern slavery is a serious problem. There are clear definitions of it and far too many examples around the world, the most serious, and probably the largest, being the Uyghurs in Xinjiang province in China.

It is all very well making an effort to acknowledge the part the London insurance market played in facilitating slavery 250 years ago but what if we are repeating that crime now? How will our descendants judge us if we stand by and do not ask serious questions about the way some of the businesses that are insured into Lloyd’s operate and their involvement in modern slavery?

They will judge us harshly, and rightly so.

Lloyd’s has decisively put to bed the speculation that has been running since the Covid pandemic lockdowns that it might leave its present Lime Street HQ. Earlier this year it finally stopped the persistent rumours that it might exercise the 2026 break clause in its lease. Now, the market authorities have said they are looking to extend the lease beyond its current end in 2031. This is not just talk. They have backed their words with investment in the main underwriting floor which re-opened recently after a major summer re-fit.

This should be welcomed by everyone who cares about ensuring London maintains its key position in the global insurance market.

Some people forget that Lloyd’s is merely a tenant in its own building. Although it commissioned the building on the site of an older Lloyd’s building from the 1920s, it no longer owns it. It was first sold to Commerzbank for £231m in 2005 before Chinese insurer Ping An paid £260m for it in 2013. The current lease extends to 2031, with that now dismissed break clause in 2026.

It is an iconic building, designed by Richard Rogers and once damned with faint praise to me by Alan Lord, the market’s chief executive when the building opened in the mid-1980s: “If you look around London at the buildings constructed since the war it makes every other office look as about as innovative as an igloo. You might love it or loathe it but you cannot be neutral about it.”

Over the subsequent decades most people have at least come to appreciate it, if not love it. It is seen the world over as the Lloyd’s building, the only truly distinctive building associated with the insurance industry in the City of London. Although people may argue that a physical presence in the City is less important in this digital age, it still sends out a clear message about the importance of the insurance industry to the fortunes of the City and, in turn, the UK economy.

The faith being shown in the building is more than affection for an important architectural feature of the City of London. It says Lloyd’s believes it has an important part to play in the market’s future – a future that also includes significant investment in a wide range of digital initiatives. It is now up to insurers, underwriters, brokers and everyone who does business through London to show they, too, are committed to that vision of a varied future.

“Brexiters outraged after crowds wave EU flag at Last Night of the Proms”, screams a headline on The Guardian website this morning.

You have to weep at the ignorance and stupidity of these brain-dead Brexiters. They pretend to care about freedom but when people exercise their own individual freedom of choice over which flag to wave at a concert they foam at the mouth with outrage.

Nobody was forced to take a flag. It was a matter of personal choice. I think it says a lot for the sort of world these right-wing fanatics want us to live in that this offends them so much. Perhaps they ought to contemplate what “Britons never shall be slaves” or “Land of Hope and Glory, Mother of the Free” really mean.

They also profoundly misunderstand the Last Night of the Proms. It is a party at the end of a two-month long season of music concerts, the longest, and widely acknowledged as the greatest, classical music festival in the world. For many years I went to the Proms every summer and you make some great friends there – indeed, it is where I met Mariette, my wife of over 40 years. The Last Night is a farewell to many of those friends for another year, an opportunity to let one’s hair down and have a sing-song together with people you have shared the most wonderful musical experiences with night-after-night for those two months. Even in the 1970s it was never, for the Promenaders, a festival of patriotism, beyond the pride of being part of a great music festival.

Even back then flags of other nations were mixed in with the Union Flags, and EU flags have been growing in number over the last decade. The fact that so many people took them when given the opportunity yesterday is a commentary on where music lovers, always internationalists, now stand on one of the great debates of our time. I expect many people were waving both an EU flag and a Union Flag: I know I would have been.

The trouble is that those now so upset about one concert in a season of over 80 events see it in isolation, having no understanding of its context. They are also no defenders of the sort of freedom I treasure.

• (Of course, there are some flags that you would not expect see there and which would be antithetical to the values of an international and increasingly diverse music festival. The EU flag is certainly not one of those. That is a wider debate for another day)

The letters column of The Guardian has been carrying several comments from readers about the media owner’s decision to block Open GI, which powers ChatGPT, from harvesting its content. Many of these correspondents argue that The Guardian should set aside its commercial interests and concerns about intellectual property and allow developers of artificial intelligence tools to use its content to “train” its own content generating machines.

The Guardian is not alone in taking this approach. Other reputable media outlets on both sides of the Atlantic are doing the same.

They are right to do so.

The argument that if you do not allow AI developers to exploit quality content then the output of their products will be poor quality because it must draw on less reputable sources is deeply flawed. Of course the developers want to be able to draw on a wide variety of sources, especially those that have invested time, money and skills in producing top quality content. It is in their commercial interests to do so. If their products produce rubbish then people will not want them – once they realise they are not reliable. It is not the job of The Guardian and the content creators that work for it and other media outlets to boost the profits of AI developers.

If the developers of AI products want to use content created by others they should negotiate proper terms and offer appropriate payment for doing so.

This seems very reminiscent of the early days of the internet when some people threw their hands up in horror at the idea that they might actually have to pay for some online content. Many argued that the internet was an open shop where anyone could use anyone else’s content – be that words, images, illustrations – without having to pay the creators. Of course, those same people would never contemplate working for nothing themselves.

We seem to be allowing artificial intelligence to drag us back into that dismal space where people think it is OK to rip off other people’s work and not pay for it.

It is not the job of content creators or media owners to polish up AI products. That is the job of developers. They will have to work much harder in vetting sources, checking facts and editing the output. Just like the rest of us who have ever worked in publishing, journalism and the creative industries do.

In the meantime, that old adage “Buyer Beware” must be first and foremost in the minds of the users of generative AI tools.